The Book That Changed The Way I Think About Money

Photo by Ivan Ragozin on Unsplash

Why are some people more successful than others? Do you have to be smart to be financially successful? Does luck play a role?

Most of my life I believed there was a cause-and-effect relationship between being financially successful and being smart, however, this book greatly challenged this belief.

The author’s argument is clear: The key to financial success is to understand human behavior, that is, when you understand how your emotions and beliefs affect your financial decisions, you will make better financial decisions.

Learn More

Learn MoreRead also: Jim Rohn’s 5 habits to instantly improve your finances in 2023 and beyond

In 5 lessons I will explain you how this book changed the way I think about money (and could change yours).

1 Luck plays a bigger role than we think

Many people underestimate the importance of luck in financial success.

Is Bill Gates smart or was he lucky? Well, both. While Bill Gates is considered one of the most successful people of the last century, many people attribute this success to his intelligence and overlook the important role luck played in his life. He was one of the few students of his time who had access to computers, which played a big role in his life.

The author warns us that we must be careful in imitating people to achieve financial success, as we often forget how lucky they were. This means that the more incredible the story, the more likely it is that luck played a more important role, and therefore, the more difficult it is to replicate.

Instead of following people, it is better to follow patterns. This way, by following specific actions that are repeated by different financially successful people, luck plays a less important role.

2 “Being wealthy” and “being rich” are not the same thing

The sooner you learn this lesson, the better.

On the one hand, being “wealthy” means having a lot of money in the bank. On the other hand, being rich means that your current income is high, therefore, you can spend this money on things as expensive as the money you have available. Therefore, you can know who is rich because you can see how much they spend, however, you cannot know if someone is wealthy because you cannot have access to their bank account.

This difference is crucial according to the author because as we learn through imitation, knowing who to imitate is crucial in our financial life. However, since you cannot see who is wealthy, it’s difficult to learn from them.

It’s important to understand that being wealthy is not about spending money, so you avoid the trap of spending all your money chasing the false illusion of “being wealthy”.

3 Learn to be happy with just enough

When you learn this, you stop taking unnecessary risks with your money.

Some people, no matter how much money they have, will always want more. Thinking this way is a dead end, since the person will never be truly satisfied, which can lead to losing everything because of unnecessary risks. That is why for the author this is one of the most important points to keep in mind to achieve financial success.

Now, how can we be happy with just enough? The answer is simple: Once you achieve the lifestyle you want, keep it and don’t change it for one that seems flashier.

4 Plan as if everything is going to go wrong

This is one of the essential lessons on financial strategy.

The author tells us throughout the book that being overly optimistic about our future can lead us into a position where we risk too much. This can lead to significant money losses due to an overlooked detail or simply bad luck. That’s why planning for things to go wrong protects us from the uncertainty of the future and increases our chances of success even if many things don’t go as we would like them to.

The author’s key point regarding this lesson is simple: Never put your entire fortune at risk and don’t bet on a single factor.

5 Know your financial goals well

When you know your goals well, you don’t get distracted by the goals of others.

This point is essential to maintaining a long-term financial strategy, as it is very easy to get distracted by the decisions others make. However, it is important to keep in mind that other people’s goals may be very different from yours. That’s why it’s very important to be sure of what your objectives are so you’re not distracted by the decisions made by others pursuing their objectives.

Here are some questions that can help you find these objectives:

What are your short/medium/long term financial goals?

What are your priorities? Do you value experiences or material things more?

What is your overall financial vision? Do you want to be debt free?

Read also: 10 daily habits made me a millionaire at 28years old

Conclusion

This book gave me a new perspective on wealth and happiness.

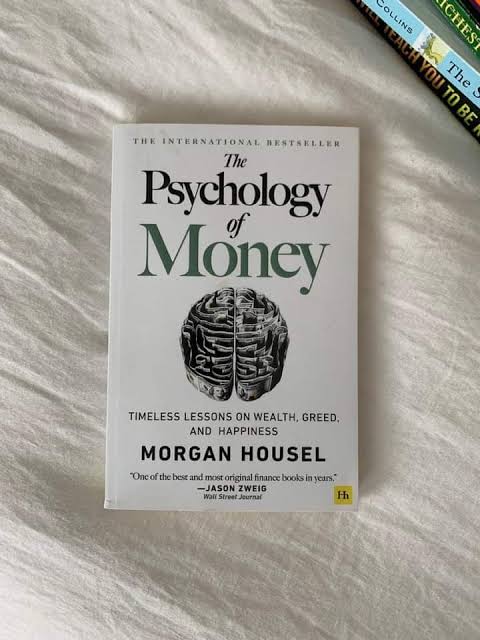

If you are looking for a book that can help you develop a better understanding of the behind the scenes of the decisions we make regarding money and how to use that understanding to your advantage, I highly recommend reading “The Psychology of Money” by Morgan Housel.

Contributed by Cristian Lopez

For more information and updates join our WhatsApp group HERE

Follow us on Twitter HERE

Join our Telegram group HERE

![The 17 Habits Of Truly Wealthy People That you can easily adopt now [Real powerful stuff]](https://worldfamilydigest.com/wp-content/uploads/2022/02/FA033A84-800B-424D-8DEA-2BB8AD9E91F6-100x70.jpeg)